Introduction

Introduction

The paper contributes to ongoing global debates on the design of effective corporate rescue procedures. Rescue procedures refer to the systems designed to rehabilitate distressed but potentially viable corporate entities where possible. Importantly, the paper situates African procedures and debates within the global discussions. In contrast to the preponderance of comparative corporate and insolvency debates, it demonstrates the insights that African countries can contribute. Thus, it challenges the notion that these countries are simply subjects of international reforms, rather than co-creators of change. Finally, it looks to inspire an alternative approach to comparative corporate and insolvency research and reforms.

This reflection on the paper sets out the main research questions which are best understood by outlining the contexts from which they emerge. Thereafter, it outlines the fascinating debate on receivership, identifying the arguments for and against. Following this, it sets out an alternative but understudied model of receivership that emerged, at least in principle, from Ghana and Nigeria before revisiting the core research questions.

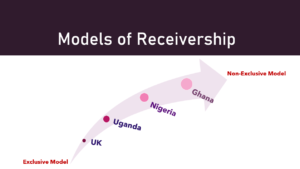

Receivership is, at its core, the enforcement remedy available to a charge-holder upon default. This remedy originated in the UK and was passed to common law African countries through colonization. In practice, a chargor grants a chargee the contractual right to enforce their powers upon default by appointing a receiver out of court; hence receivership is a privately ordered remedy. The receiver takes control of and sells assets subject to the charge. The presence of a floating charge usually involves the grant of additional management powers. The receiver and manager with rights over the whole or substantially the whole of the company’s assets is designated the administrative receiver in the UK and Uganda but is simply designated receiver and manager in Ghana and Nigeria. The paper is concerned with the equivalent of the administrative receiver, which it refers to, simply, as ‘receiver’.

The appointment of the receiver displaces the directors of the company, whose powers remains in abeyance during the pendency of the procedure. In contrast to the directors however, the receiver exercises their powers in the interest of the appointor, not the company or any of its other stakeholders. It is important to note here that this traditional model of (administrative) receivership was modified in some common law countries in Africa, as will be discussed subsequently.

Context and Research Questions

The first research question and motivation for the paper emerged from reflections on recent reforms to the rescue procedures of some common law African countries. While it focuses primarily on Ghana, Nigeria and Uganda, the same analysis can be extended to their counterparts. As is usual from previous reform cycles, these countries have looked to the UK system and within this, predominantly the English system, for direction. Interestingly, these 3 African countries have not followed the UK’s decision in 2003 to restrict receivership in favour of the administration procedure. Conversely, Ghana, Nigeria, and Uganda have retained receivership, to which they have added administration. Some conjecture suggests that this choice is attributable to the failure of the administration procedure in providing a superior rescue mechanism to receivership in England and Wales. The key difference is that administration requires the insolvency practitioner, by law, to consider the interests of the creditors as a group, while receivership requires the practitioners, by law, to prioritise the interests of the appointing creditor. This context provides an opportunity determine which reform decision was rightly made and leads to the first research question of the article:

- Whether administration offers a superior rescue mechanism to receivership (or vice versa).

In the lead up to the UK decision to elevate administration above receivership, it was suggested that an alternative would simply be to reform receivership. However, no viable alternative model of receivership was mooted. Whereas, in Ghana and Nigeria, there exists a different approach to receivership, at least in principle. The paper argues that this understudied model of receivership offers, a more suitable counterpoint to administration. It raises the second research question:

- Whether receivership can be modified to deliver effectively as a rescue mechanism.

On Receivership: Merits and Challenges

There are two key decisions at the heart of rescue procedures: (i) who makes the rescue decision (ii) When is it made? Ideally, directors are best placed to make the decision to rescue, and they ought to make it timely to avoid further destruction of value. Where they do not, then decision-making powers should be allocated to creditors. However, these are usually dispersed with varying degrees of interest and sophistication, which affect their ability to act effectively as a cohesive group. In the UK, Armour and Frisby have argued that private ordering through the concentrated creditor who holds vast information and enforcement rights via covenants and security rights offers a viable counterpoint to the directors and [administrative] receivership provides a vehicle for the efficient disposal of assets by a concentrated creditor, following a decision by that creditor to enforce. The arguments for receivership are thus rooted in its practical efficiency. Nevertheless, it is plagued by two main challenges. First, it fails to offer an inclusive procedure for rescue decision-making by centering the interests of the appointor. Second, that it fails to maximise the value in the assets because it does not give troubled but viable companies or businesses sufficient opportunities to be rescued; thus, permitting the liquidation of too many viable companies and/or their businesses.

Its proponents nevertheless argue that the superiority of a more inclusive system is more illusory than real due to direct and indirect costs which would inhibit optimal outcomes. Further, that the inclusion challenge could have been remedied instead by simply rendering the administrative receiver accountable to all stakeholders. Having failed to set out how this may work in the lead up to the 2003 reforms, the paper introduces an alternative model of receivership which is found in Ghana and Nigeria through which to test some of the assertions.

While the Ghanaian model attributes directors’ duties to the receiver, its Nigerian counterpart does not go that far. The Ghanaian model was introduced via the Companies Act 1963, while the Nigerian model was introduced via the Companies and Allied Matters Act 1990. The paper thus argues that there are various models of receivership available in common law countries and that as far back as the 1960s, African countries had recognised the need for more inclusive procedures.

While the Ghanaian model attributes directors’ duties to the receiver, its Nigerian counterpart does not go that far. The Ghanaian model was introduced via the Companies Act 1963, while the Nigerian model was introduced via the Companies and Allied Matters Act 1990. The paper thus argues that there are various models of receivership available in common law countries and that as far back as the 1960s, African countries had recognised the need for more inclusive procedures.

Addressing the Research Questions

The rest of the paper examines the extent to which the non-exclusive model of receivership addresses the two key challenges of the traditional model of receivership. It argues that while the non-exclusive model clearly addresses these challenges, additional changes would be required to achieve those ends. It is most unfortunate that even though the challenges of the non-exclusive receivership have been known to reformers in Ghana and Nigeria, they made no effort to reform these.

Thereafter, the paper examines the extent to which any model of receivership – exclusive or non-exclusive is superior to administration. To answer this, the paper provides novel insights into the arguments preceding the restriction of receivership in the UK. It argues that the proponents of receivership have a perspective that portrays rescue as taking place prior to the initiation of the formal procedure. For them, the formal procedure is simply an enforcement event. Whereas the advocates of administration are oriented towards the locating the entirety of the rescue within the formal process. The paper argues against rescue-as-enforcement. Instead, it calls for rescue as a governance tool. Additionally, that rescue procedures that exclude other stakeholders trigger questions about their legitimacy that affect the reputation of the system as a whole. As some global discussions shift towards more exclusive rescue systems, it is important that the implications are fully addressed.

B. Adebola, ‘Diversifying Rescue: Corporate Rescue and the Models of Receivership’ [2023] 34(10), I.C.C.L.R. 572.

The paper was funded by an AHRC grant relating to CLRNN and the accepted version of the paper is published open access and available via this link.

The paper was selected by the Insolvency Service – Regulator in the UK as one of the papers for its Forward-Thinking Conference 2023. The presentation is available via this link.

Dr Bolanle Adebola is an Associate Professor at the University of Reading. She is the Convener of CLRNN and Co-convener of the CLRNN Spotlight on Corporate Governance and Insolvency Law in Africa. She is available at b.adebola@reading.ac.uk.